Can a billionaire's deal redefine the landscape of corporate America? A bold $900 million agreement between Howard Hughes Corporation and Bill Ackman’s Pershing Square Capital Management certainly suggests so. This transaction not only highlights the financial acumen of both parties but also underscores the evolving dynamics of modern business partnerships. The move positions Ackman as the executive chairman of the Howard Hughes board, while current CEO David O'Reilly continues in his role. Such strategic alliances are increasingly becoming a hallmark of today's competitive market environment.

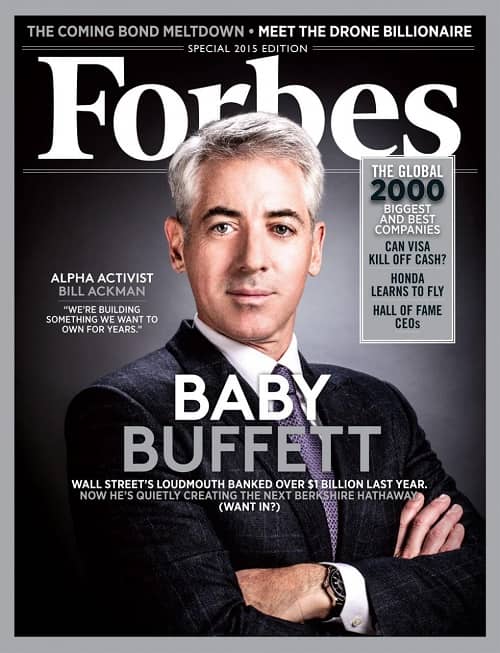

Born on May 11, 1966, William Albert Ackman is more than just an investor; he is a visionary who has transformed the hedge fund industry with his audacious strategies. As the founder and CEO of Pershing Square Capital Management, Ackman manages assets worth billions, making him one of the most influential figures in global finance. His career trajectory is marked by high-stakes bets that have either catapulted companies to success or resulted in significant controversy. From his early days navigating complex financial waters to becoming a household name among investors, Ackman's journey is nothing short of extraordinary. Yet, it is his ability to challenge conventional wisdom that sets him apart from peers in the industry.

| Full Name | William Albert Ackman |

|---|---|

| Date of Birth | May 11, 1966 |

| Place of Birth | New York City, USA |

| Education | B.A., Harvard College (1988) |

| Profession | Hedge Fund Manager, Activist Investor |

| Net Worth | $1.4 billion (as of 2023) |

| Company Founded | Pershing Square Capital Management |

| Notable Investments | MBIA, Herbalife, Valeant Pharmaceuticals |

| Philanthropy | Supports education initiatives, healthcare reform |

| Reference Website | Pershing Square Capital Management |

Ackman’s investment philosophy revolves around identifying undervalued companies and leveraging activist tactics to drive shareholder value. One of his earliest and most controversial bets was against MBIA, where he successfully exposed fraudulent practices within the insurance giant. This victory cemented his reputation as a shrewd operator willing to take calculated risks. However, not all his ventures have been met with universal acclaim. His campaign against Herbalife, for instance, sparked intense debate over whether the company constituted a pyramid scheme. Despite losing this particular battle, Ackman remains unapologetic about his convictions, asserting that integrity and transparency are cornerstones of ethical investing.

In recent years, Ackman has emerged as a vocal advocate for economic policy reforms. During Donald Trump's presidency, he warned of potential economic nuclear war if proposed import tariffs were implemented without careful consideration. Such outspokenness reflects his commitment to safeguarding investor confidence amidst turbulent political climates. Moreover, Ackman’s influence extends beyond Wall Street into academia and public discourse. Having graduated from Harvard College in 1988, he frequently speaks at prestigious institutions, sharing insights gained through decades of experience.

The partnership between Howard Hughes Corporation and Pershing Square exemplifies how seasoned professionals can collaborate to achieve mutual goals. By acquiring a substantial stake in Howard Hughes, Ackman aims to unlock latent value within the real estate conglomerate. With approximately 43% of his hedge fund's $14.8 billion portfolio tied to this venture, the stakes could not be higher. Everyday investors stand to benefit indirectly as well, given the ripple effects such deals often generate across markets. Nonetheless, critics caution against excessive concentration of wealth and power in the hands of a select few.

Ackman’s legacy will likely hinge on his ability to balance ambition with accountability. While his detractors accuse him of prioritizing personal gains over broader societal interests, supporters admire his relentless pursuit of excellence. Regardless of perspective, there is no denying that Ackman has redefined what it means to be a successful financier in contemporary times. Through innovative approaches to asset management and unwavering dedication to principles, he continues to shape the future of modern finance.

| Key Facts About Howard Hughes Corporation | - Established in 1987 - Headquarters: Dallas, Texas - Industry: Real Estate Development - Notable Projects: Summerlin, Ward Village - Market Capitalization: ~$5 billion (as of 2023) - Strategic Partner: Pershing Square Capital Management |

|---|

As we delve deeper into the nuances of this collaboration, several questions arise regarding its long-term implications. Will Ackman’s involvement lead to transformative changes within Howard Hughes Corporation? Or might it expose vulnerabilities inherent in large-scale property development ventures? Only time will tell whether this alliance proves beneficial for stakeholders involved. What is clear, however, is that Bill Ackman’s imprint on corporate America will endure far beyond the lifespan of any single deal.