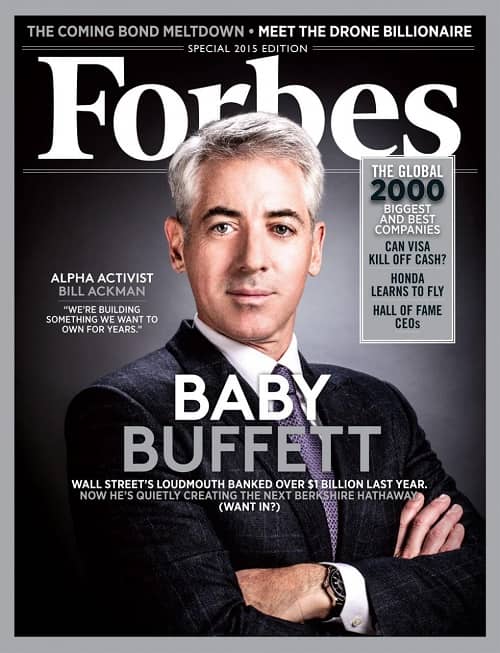

Can Bill Ackman truly be the next Warren Buffett? This question has been on the minds of many in the financial world as Ackman continues to make bold moves reminiscent of the legendary investor. A bold statement that resonates with investors is his unwavering commitment to long-term value creation, a philosophy that mirrors Buffett's approach. With billions under management and a reputation for shaking up corporate boards, Ackman's ambition is clear: to carve out a legacy as one of the most influential investors of our time.

Born into a family deeply rooted in the world of finance, Ackman's journey began at Harvard, where he honed his analytical skills and developed a keen interest in the intricacies of markets. His career took off when he founded Gotham Partners, a hedge fund that laid the groundwork for his future endeavors. The transition to Pershing Square Capital Management marked a pivotal moment in his professional life, allowing him to pursue activist investing strategies with greater focus and resources. Through this platform, Ackman has engaged with numerous high-profile companies, often sparking controversy but always generating significant attention.

| Personal Information | Details |

|---|---|

| Full Name | William Henry Ackman |

| Date of Birth | May 26, 1966 |

| Place of Birth | Pittsburgh, Pennsylvania, USA |

| Education | Harvard College (B.A.), Harvard Business School (M.B.A.) |

| Net Worth | $3.5 billion (as of 2023) |

| Career Highlights | Founder and CEO of Pershing Square Capital Management; Activist Investor |

| Notable Investments | MBIA, Herbalife, General Growth Properties |

| Political Views | Supporter of Donald Trump; Advocate for free-market policies |

| Philanthropy | Donations to education and healthcare initiatives |

| Reference | Bloomberg Billionaires Index |

Ackman's investment strategy revolves around identifying undervalued assets and leveraging his influence to drive change within target companies. One of his most notable successes came with his involvement in MBIA, where his short bet against the bond insurer proved both lucrative and controversial. Despite facing criticism from peers and regulators, Ackman stood firm in his convictions, ultimately validating his approach when MBIA's financial troubles became public knowledge. This episode underscored his ability to think independently and act decisively, traits that have defined much of his career.

Another defining moment in Ackman's portfolio was his battle with Herbalife, a company he famously described as a pyramid scheme. Over several years, Ackman waged a public campaign against Herbalife, arguing that its business model was unsustainable. While the outcome remains debated, the saga highlighted Ackman's willingness to take on formidable adversaries and challenge established norms. It also showcased his adeptness at using media platforms to amplify his message, a tactic that has become increasingly central to his activism.

In recent years, Ackman has expanded his horizons beyond traditional activist investing. His partnership with Howard Hughes Corporation exemplifies this evolution, as he shifted toward real estate development—an area traditionally associated with Buffett's Berkshire Hathaway. By acquiring a substantial stake in Howard Hughes, Ackman demonstrated his capacity to adapt while staying true to his core principles of value creation. This move not only diversified his holdings but also positioned him favorably in an industry poised for growth.

As a vocal supporter of Donald Trump, Ackman has ventured into political discourse, offering insights on economic policy and global trade. His warnings about potential economic nuclear war resulting from tariff disputes reflect his broader concerns about macroeconomic stability. While some critics dismiss his political commentary as self-serving, others recognize the value of his perspective, particularly given his extensive experience navigating complex financial landscapes.

Ackman's influence extends beyond the boardroom and trading floor. He has made significant contributions to philanthropy, focusing on areas such as education reform and healthcare access. His donations often align with his belief in empowering individuals through opportunity, echoing themes present in his professional pursuits. Whether advocating for affirmative action or supporting causes close to home, Ackman demonstrates a commitment to making a positive impact beyond financial returns.

Despite his achievements, Ackman faces ongoing scrutiny from detractors who question his methods and motivations. Critics point to instances where his aggressive tactics may have prioritized short-term gains over long-term benefits for stakeholders. However, supporters argue that his track record speaks for itself, citing examples where his interventions led to meaningful improvements in corporate governance and shareholder value.

The parallels between Ackman and Buffett extend beyond their shared focus on value investing. Both men possess charismatic personalities and excel at communicating complex ideas to diverse audiences. They also share a knack for timing market opportunities, whether through contrarian bets or strategic acquisitions. Yet, while Buffett has cultivated an image as a folksy grandfather figure, Ackman embraces a more combative persona, unafraid to engage in heated debates or challenge conventional wisdom.

Looking ahead, Ackman's aspirations remain ambitious. He envisions building a conglomerate akin to Berkshire Hathaway, combining operational expertise with financial acumen to create enduring value. To achieve this vision, he continues to refine his approach, learning from past experiences and adapting to changing market conditions. As he navigates the challenges and opportunities of modern capitalism, Ackman's journey serves as a testament to the power of perseverance, innovation, and conviction.

For those watching from the sidelines, the question of whether Ackman can replicate Buffett's success remains open-ended. What is certain, however, is that his contributions to the field of investing will leave a lasting imprint, inspiring future generations to pursue excellence with purpose and integrity.