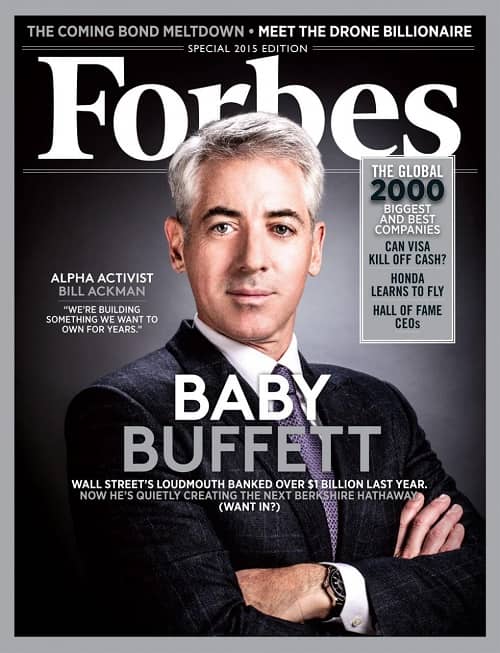

Who is Bill Ackman, and why does his name resonate so deeply within the corridors of global finance? A bold statement to consider: Bill Ackman has not only reshaped the landscape of modern investing but also redefined what it means to be an activist investor. His audacious bets, often polarizing, have left indelible marks on industries ranging from real estate to consumer goods. As one of the most influential figures in contemporary finance, Ackman’s journey from a young entrepreneur to a billionaire hedge fund manager is nothing short of extraordinary.

Born into a family with modest beginnings, Ackman quickly distinguished himself as a prodigious thinker with an uncanny ability to identify undervalued assets. His rise to prominence began with the establishment of Gotham Partners in 1992, which laid the groundwork for his eventual creation of Pershing Square Capital Management in 2004. Under Ackman's leadership, Pershing Square evolved into a powerhouse, managing billions in assets and executing some of the most daring investment strategies in history. One notable example includes his controversial yet successful bet against MBIA, a move that earned him significant returns amidst widespread skepticism. Another defining moment came with his prolonged battle against Herbalife, where he wagered $2 billion that the company was operating as a pyramid scheme—a stance that sparked heated debates across Wall Street.

| Bio Data & Personal Information | Details |

|---|---|

| Full Name | William Albert Ackman |

| Date of Birth | May 26, 1966 |

| Place of Birth | Queens, New York City, United States |

| Education | Bachelor of Arts in Economics (Harvard University) |

| Citizenship | American |

| Net Worth (Approx.) | $1.5 billion (as of 2023) |

| Career Highlights | Details |

| Founder of | Pershing Square Capital Management |

| Notable Investments | MBIA, Herbalife, General Growth Properties, Pfizer, Starbucks |

| Major Achievements | Spearheading activist campaigns; transforming underperforming companies |

| Philanthropy | Donations to Harvard University, support for mental health initiatives |

| Controversies | Herbalife dispute, public disagreements with corporate executives |

| Reference Website | Pershing Square Capital Management |

Ackman’s approach to investing is characterized by meticulous research and unwavering conviction. He meticulously analyzes companies, often spending months or even years studying their operations before making any moves. This diligence has led to several high-profile successes, such as his involvement with General Growth Properties during the financial crisis of 2008. By restructuring the company’s debt and steering it toward profitability, Ackman demonstrated his knack for turning around struggling enterprises. Similarly, his stake in Starbucks exemplified his ability to recognize long-term value, even when market sentiment remained lukewarm.

However, Ackman’s career is not without its share of controversies. His public feud with Herbalife became one of the most talked-about episodes in modern finance. Despite mounting evidence supporting his claims, regulatory bodies failed to substantiate his allegations, leading to substantial losses. Yet, rather than retreating quietly, Ackman used this experience to refine his strategies and enhance his reputation as a tenacious advocate for shareholder rights.

In addition to his professional pursuits, Ackman has been a vocal proponent of social causes. His generous contributions to educational institutions like Harvard underscore his commitment to fostering intellectual growth. Moreover, his efforts in promoting mental health awareness reflect a broader vision of creating positive societal impact. These endeavors highlight the multifaceted nature of Ackman’s persona—one that transcends mere financial acumen to encompass genuine concern for community welfare.

Ackman’s influence extends beyond traditional finance, particularly in the realm of real estate. His partnership with Howard Hughes Corporation exemplifies his ambition to build enduring legacies. The $900 million deal struck between Pershing Square and Howard Hughes Holdings signifies a strategic alliance aimed at transforming The Woodlands into a model for sustainable urban development. This collaboration underscores Ackman’s forward-thinking approach, blending economic viability with environmental responsibility.

As Ackman continues to navigate the ever-evolving world of finance, his legacy remains firmly rooted in innovation and resilience. Whether through groundbreaking investments or transformative partnerships, he consistently pushes boundaries while adhering to core principles of integrity and transparency. For aspiring investors and seasoned professionals alike, Ackman serves as both an inspiration and a cautionary tale—a testament to the power of perseverance coupled with calculated risk-taking.

While critics may question certain aspects of Ackman’s methods, there can be no denying his profound impact on the global financial ecosystem. From reshaping corporate governance structures to championing socially responsible practices, his contributions extend far beyond monetary gains. As he looks ahead to new opportunities, one thing remains clear: Bill Ackman will remain a pivotal figure in shaping the future of finance for generations to come.