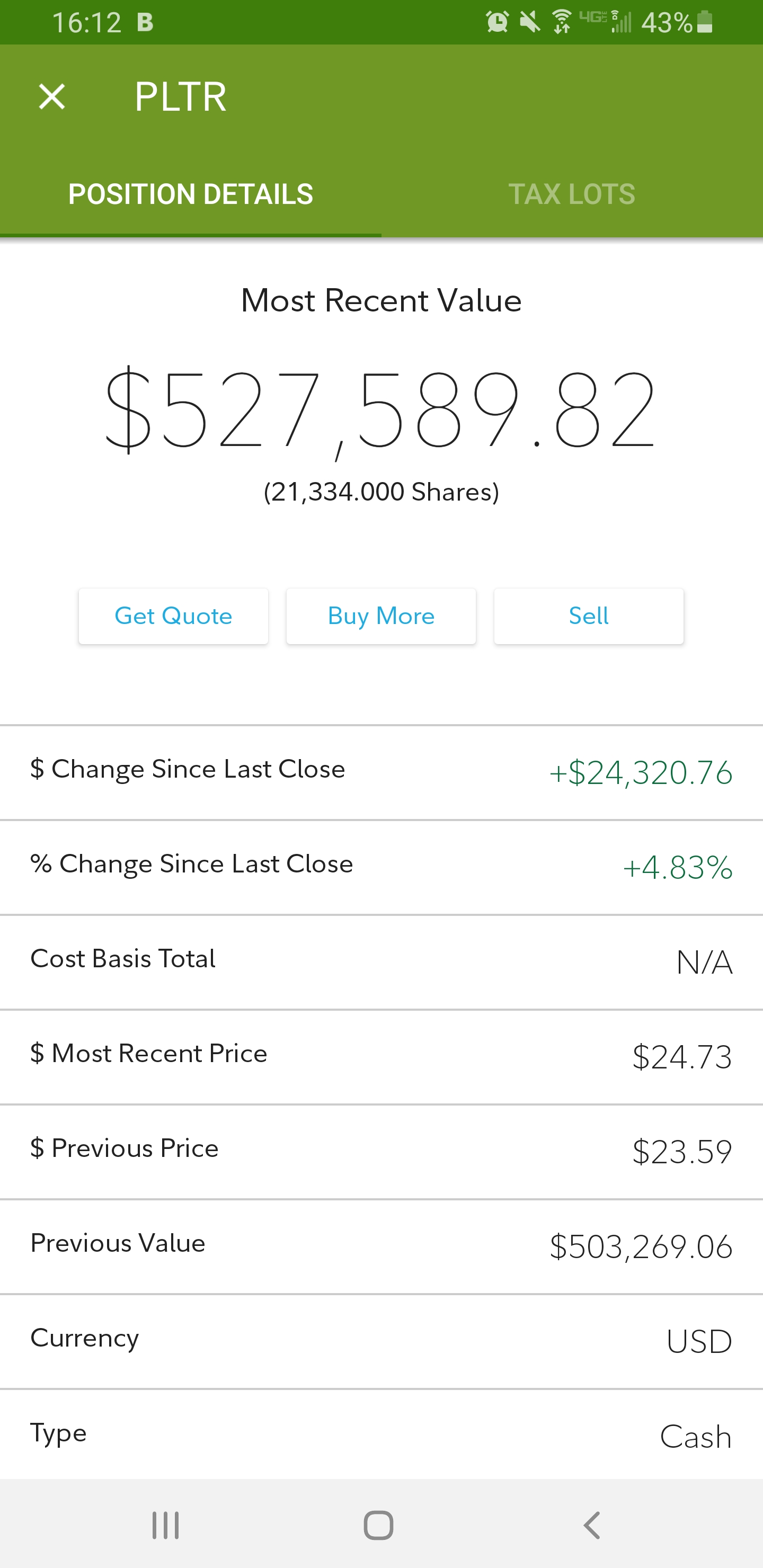

Is Palantir Technologies truly on the brink of a new era with artificial intelligence driving its growth? A bold statement suggests that this company, known for its advanced data analytics solutions, is set to redefine industries across the globe. With revenue rising by an impressive 39%, investors are watching closely as the stock price fluctuates despite strong performance indicators.

Palantir Technologies Inc., trading under the ticker symbol PLTR, has been making waves in both commercial and government sectors. The company's recent earnings report indicates robust financial health, yet shares slipped slightly in after-hours trading. This reaction from investors highlights the cautious optimism surrounding PLTR's future prospects. Despite posting in-line earnings and raising its full-year guidance, questions remain about how effectively Palantir can leverage its AI capabilities to maintain momentum. The firm's ability to double its net income in the latest quarter further underscores its potential, even as market sentiment remains mixed.

| Bio Data & Personal Information | Career & Professional Information |

|---|---|

| Name: Alex Karp | Position: CEO of Palantir Technologies |

| Age: 54 | Industry: Technology / Data Analytics |

| Place of Birth: Moscow, Russia | Years of Experience: Over 20 years |

| Education: Stanford University (BA), Harvard Law School (JD) | Notable Achievements: Co-founded Palantir in 2003; expanded operations globally |

| Official Website | Key Focus Areas: Government contracts, commercial clients, AI development |

As one of the leading software companies serving Western-allied nations, Palantir continues to refine its offerings for both public and private sectors. Its unique approach combines sophisticated algorithms with user-friendly interfaces, enabling organizations to harness vast datasets efficiently. Analyst forecasts paint a nuanced picture of PLTR's trajectory, with some predicting steady growth while others caution against overvaluation. According to 21 analysts surveyed, the average rating for PLTR stock stands at Hold, reflecting tempered expectations amidst ambitious goals.

The 12-month stock price forecast sits at $78.79, representing a decrease of -36.60% compared to the latest price. However, such projections often fail to account for intangible factors like brand reputation, technological innovation, and strategic partnerships. For instance, Palantir's collaboration with major defense contractors and global enterprises positions it favorably within key markets. These alliances not only bolster revenue streams but also enhance credibility among stakeholders who value reliability and cutting-edge solutions.

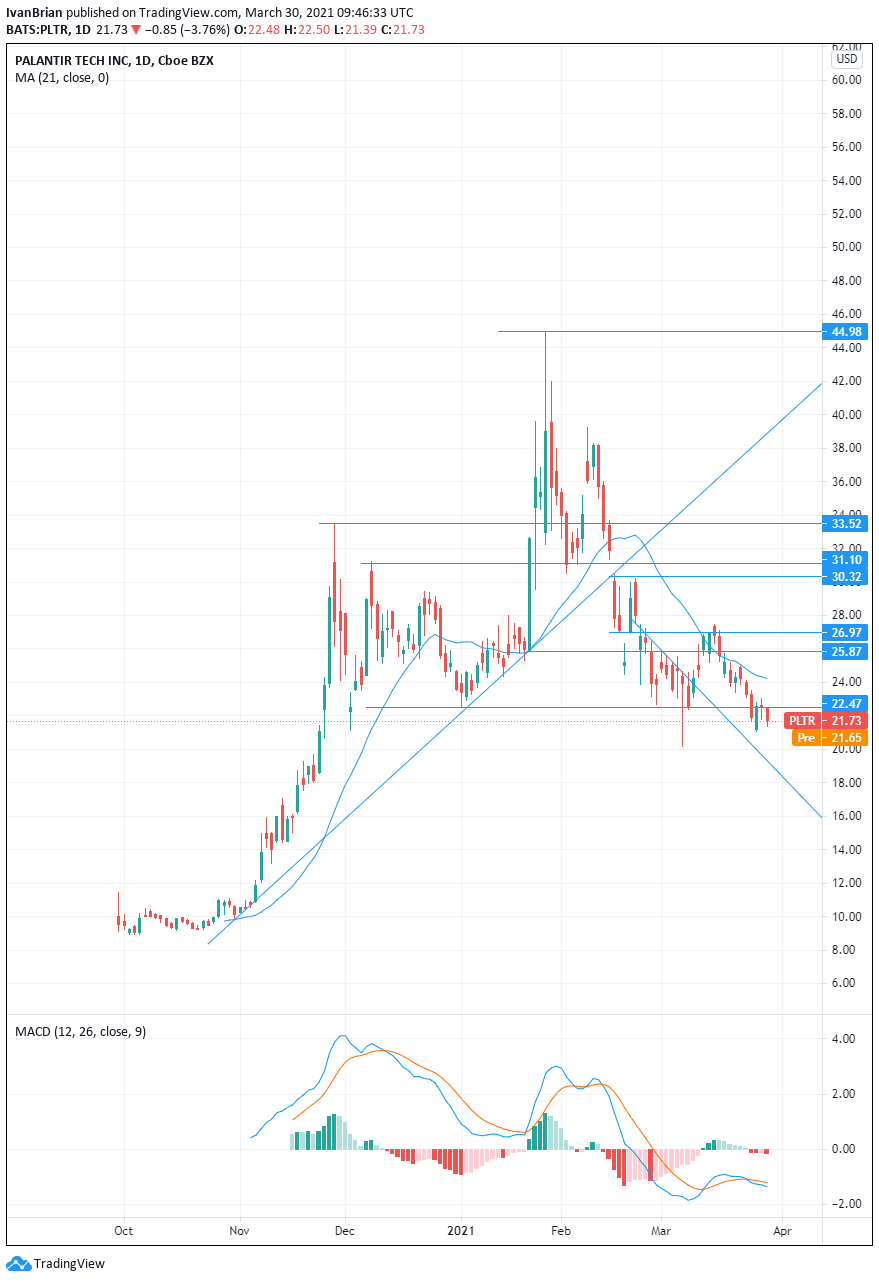

Morningstar provides comprehensive insights into PLTR's financial standing, including real-time quotes, charts, historical performance, and sustainability metrics. Their analysis reveals that while Palantir excels in delivering high-impact results, challenges persist regarding scalability and cost management. As the company navigates these hurdles, maintaining transparency with shareholders becomes increasingly important. By doing so, Palantir aims to build trust and foster long-term relationships based on mutual benefit.

Investors considering PLTR must weigh various elements before committing capital. On one hand, the organization boasts remarkable achievements in leveraging artificial intelligence to solve complex problems. From optimizing supply chains to enhancing national security measures, Palantir demonstrates versatility unmatched by many competitors. Conversely, concerns linger around execution risks and competitive pressures as rivals strive to capture similar opportunities.

In summary, Palantir Technologies represents a compelling case study in modern enterprise transformation driven by technology. While uncertainties exist regarding valuation and market dynamics, there is no denying the transformative impact this entity could have moving forward. Stakeholders would do well to monitor developments closely while keeping broader macroeconomic trends in perspective. Ultimately, success hinges upon executing visionary strategies aligned with evolving customer needs—an endeavor requiring unwavering commitment and adaptability.

Real-time updates concerning PLTR stock prices, along with detailed analyses, are available through platforms such as Morningstar and MarketWatch. These resources offer invaluable perspectives for those seeking deeper understanding of Palantir's current position and potential pathways ahead. Whether viewed as pioneer or disruptor, one thing remains clear: Palantir Technologies plays an integral role shaping tomorrow's digital landscape.